We have just come through 2020, a year like no other. We have not come through unscathed. Businesses have suffered. Many have been reduced to half capacity. Staff has been laid off, many more are working from home, and offices are empty. The whole nature of business has shifted. Virtual meetings are now the norm, and business models developed ways to survive with online orders of groceries and goods, curbside pickup, and delivery of restaurant orders to name but a few. It seems the only “winner” in 2020 was eCommerce, which flourished and increased their market share by over 37% from the prior year.

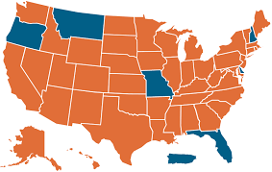

Regardless whether your business is struggling and you are counting every penny, or if your business is one of the ones that opportunity smiled upon, Sales Tax is a common factor of both. Governments of all levels generate their revenue by taxation and these arethe funds that have helped an immeasurable number of people this past year. Due to the business slowdown, government revenues have also declined, and 2021 is going to bring some changes as city, state, and federal agencies try to increase their revenues to continue to provide services for the population. The best defense is a good offense so let’s take a look at the anticipated Sales Tax Changes for 2021 and get prepared!

Avalara has a team of tax experts who live and breathe tax compliance for Sage 300 (Accpac) and Sage Intacct. You know your business and they know taxes. Here are some of what these tax wizards are telling us to expect this year:

Sales tax is needed now, more than ever, as cities, states, and federal agencies look to increase their revenues to continue to create services and benefits for their citizens during and after the Covid-19 pandemic. Be aware, and don’t be caught unprepared! If are using Sage 300 or Sage Intacct and you would like to learn more about Avalara and the expected Sales Tax Changes for 2021, or if you would like to talk to someone about your specific sales tax situation, contact us at Equation. We can help ease your burden.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016