For many companies, fixed assets like property, machinery, and equipment represent their largest capital investment. When you consider equipment that moves around, assets that constantly come in and out of service, and depreciation rules that are continuously changing though, tracking fixed assets quickly becomes a moving target.

That’s why you should take a closer look at Fixed Asset Accounting Software.

Built-in formulas for over 50 depreciation methods automate the calculation of accurate depreciation entries without having to track or memorize complex tax rules.

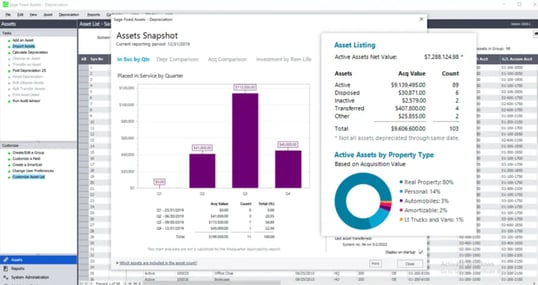

A variety of ready-to-use reports and tax forms help to ensure total tax compliance. And with so many options to customize the format, appearance, and context of your reports, you’ll know your assets inside and out.

Using state-of-the-art bar code labels and readers, you can track all assets from acquisition to disposal which can eliminate lost equipment and reduce insurance and tax overpayments.

Construction in-progress (CIP) features help you track fixed assets from start to finish and easily monitor all project details.

If you’re currently using Sage 300 for accounting, you’ll be happy to know that Sage Fixed Assets (Sage FAS) integrates seamlessly with your general ledger, accounts payable, and purchasing modules.

That means when you purchase a new asset in Sage 300, it’s automatically added and tracked in Sage FAS. Plus, depreciation calculations from Sage FAS will automatically create the appropriate journal entries in your Sage 300 general ledger.

When all of your asset data is synchronized with transactions in Sage 300, you improve accuracy and eliminate duplicate data entry.

Integrated or Standalone - The Choice is Yours

If you aren’t using Sage 300, you can still run Sage FAS as a standalone application and leverage all the same features and power of automated fixed asset management. Sage FAS also integrates with Sage 50, Sage 100 and X3.

Contact us to find out more.

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016