The California State Board of Equalization has announced new sales and use tax rates effective July 1, 2011

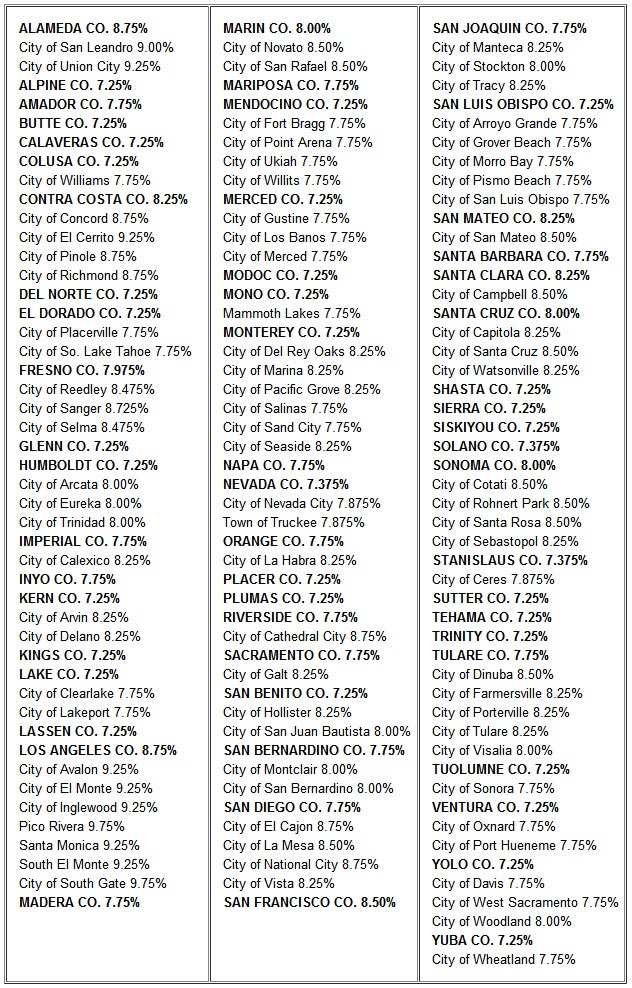

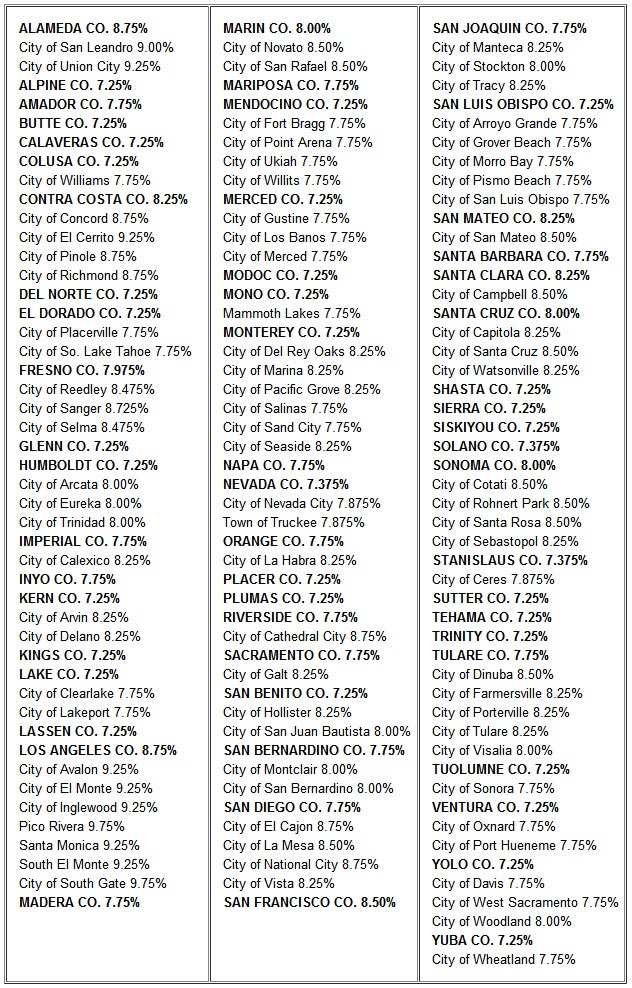

Effective July 1, 2011, the one percent sales and use tax rate increase that was approved with the state budget and effective April 1, 2009, will expire lowering the statewide base tax rate from 8.25 percent to 7.25 percent. In areas where there are voter-approved district taxes, the total tax rate related to sales and purchases will be the statewide base tax rate of 7.25 percent plus the applicable district tax. The table below summarizes the new sales and use tax rates.

Download the full list of California City and County Sales and Use Tax Rates PDF document.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016