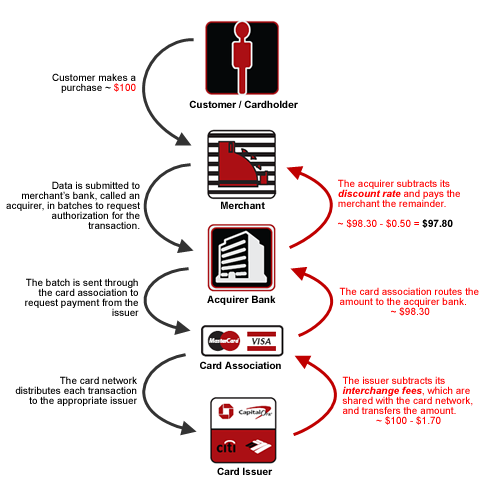

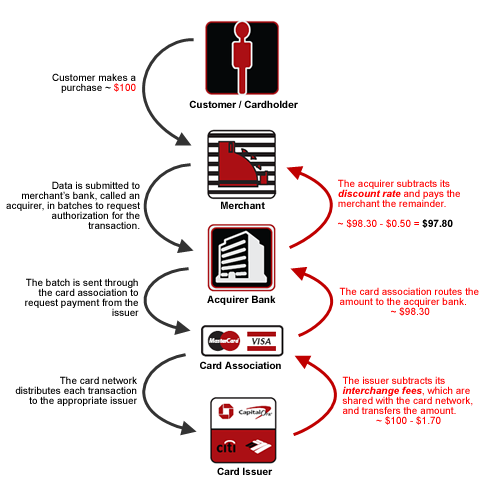

Now that we have an understanding of how credit card payments are processed, let's take a look at how the processing fees are calculated. Here are some of the basic terms or steps used; Authorization, Batching, Clearing and Funding.

The above is an example of how payment processing fees are calculated. Generally the interchange fee can range between 1 - 3% depending the on type of card used and the transaction amount. As for the discount fee, the percentage for this also varies and it can be influenced by numerous factors such as how the card is processed and the type of card. The range for discount fee ranges from 1% up to 5%. It is important to get comparison discount rates offered by the merchant account or acquiring bank as this rate is very competitive.

If you are processing credit card payments today and are curious to find out how much you can save on processing fees we can provide a side-by-side savings analysis. Get a No Obligation Quote!

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016