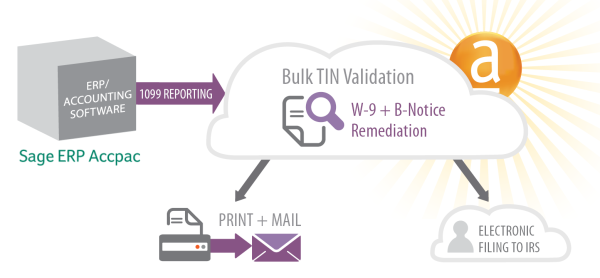

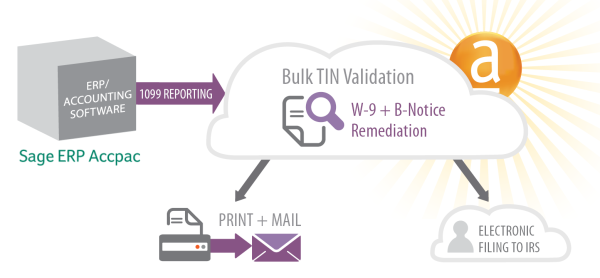

Yes, we are close to that time of the year again...year-end processing and then followed by annual filings to IRS. Do you currently have stacks of 1099 forms to print and mail on an annual basis? The hassle of purchasing costly 1099 forms, aligning the forms to print, stuffing envelopes...well the list goes on and on. Well, the good news is you can now automate this process in 3 easy steps!

All you need to do is:

Yes that's it. You don't have to deal with printing, mailing and filing. Leave these hassle to the AvaTax1099!

In addition to offering a seamless process, AvaTax1099 is fully compliant with the most current legislative requirements so you can have a peace of mind. It is also compatible with most ERP solutions including Sage Accpac ERP, Sage MAS, QuickBooks, and more. Since this is a hosted cloud solution, there is no IT support to deal with.

List of supported forms:

All form formats are guaranteed compliant reducing the risk of an IRS audit.

Take the next step towards automating your 1099 process -- Learn how to get started and attend the webinar.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016