Payroll Tax Updates Bring Changes to Payroll Government Reports Introducing Sage Payroll Tax Forms and eFiling by Aatrix

Introducing Sage Payroll Tax Forms and eFiling by Aatrix

Users of Sage 300 Payroll with the more recent payroll tax updates activated (the exact version may differ depending on which states the business operates in) will notice that the “Payroll Government Reports” section has been revamped and that some familiar icons are gone. Many clients do not access this section of payroll very often as reports are only run quarterly or even annually. However, with deadlines looming, the last thing anyone wants is to waste time looking for reports and forms that are nowhere to be found! Below you will find Equation’s guide to accessing reports in the updated system as well as more information about new e-filing options offered by Aatrix in partnership with Sage:

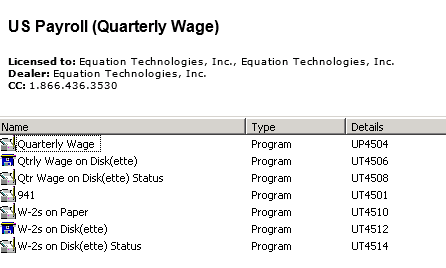

In prior versions, the Payroll Government Reports section would resemble the first image. Most notably, the Federal Form 941 has its own icon.

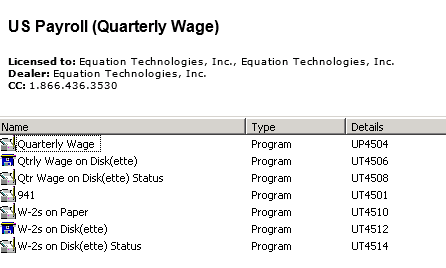

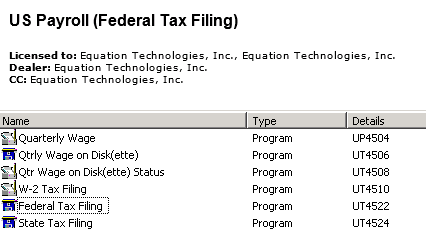

Clients with the latest payroll tax updates activated will now see the below list of report options:

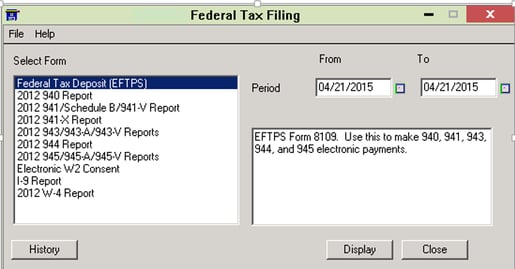

To access the 941 and other Federal Tax Forms (including W-2s), simply click on the Federal Tax Filing Icon and choose from a list of report and form options. In the example below, the client will need to update their forms using the Aatrix “Automatic Update” button (access by clicking the “Display” button) before the reports will reflect the current tax year.

An exciting new feature included with the latest Payroll updates is Sage Payroll Tax Forms and efiling by Aatrix. This functionality provides updated reports and forms at no cost and enables users to fill out and e-file tax forms for a fee. Electronic filing is available for W-2, W-3, U.S. Federal Forms (941, 943, 944, and 945), U.S. State tax forms, and new hire reporting by state. Users can continue to run and print payroll reports and forms for free with confidence that they are using the most recent versions available.

Clients accustomed to printing and mailing tax forms should make sure that they are aware of form requirements prior to ordering paper stock. For example, W-2s must be printed on Laser W-2 4-Up Blank with backer on all 4 panels.

Clients interested in Aatrix’s e-file service can find more information, including pricing, here:

http://partner.aatrix.com/partners/sage300erp/

If you would like more information on the changes to Government Reporting and Tax Filing in Sage 300 Payroll, or need to make sure you have access to the latest payroll update, please contact Equation Technologies today.Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016