Tax Table Updates for Sage 300 ERP U.S. payroll customers for June 30, 2013 is now available for download.

Before installing the tax update:

There are no Federal legislative updates in Sage ERP Accpac U.S. Payroll for the Q2 2013 period.

This section only applies of local tax codes are used. After the Tax Update has been installed and activated, click the Install Repository button in the Local and Other Custom Taxes function to update all local rates.

NOTE: If any of your local tax codes use the calculation method Percentage of Base, you must update each employee assigned that tax code. This ensures the rate at the employee level is correct.

This section lists the state and local updates available with this release. If a state or locality is not listed in this section, there are currently no tax updates or product modifications for that state or locality.

You can obtain documentation regarding the specific State and Local tax updates details from any of the following areas:

Files pertaining to the US Payroll Tax Update will have filenames that start with “UT” and the Canadian Payroll start with "CT".

If you use Sage ERP Accpac U.S. Payroll v 5.6, 6.0 and 6.1, you can use your program to produce the following:

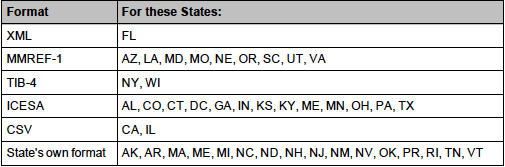

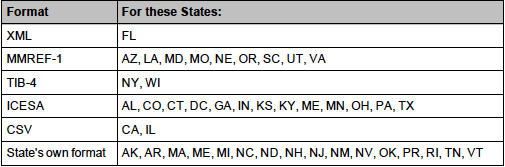

Sage ERP Accpac U.S. Payroll produces the data on diskette or hard disk in the following formats:

For all other states not listed, Sage ERP Accpac U.S. Payroll produces a report in the general ICESA format. Click here to download the Notes and Instructions for Quarterly Wage on Disk(ette).

In order to download the update, customers must have a current Payroll Update Plan (PUP) or be a Priority Software Support (PSS) subscriber as of the tax table effective date. Please contact Equation Support if you require assistance to install the US Payroll Tax Update.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016