Taxes are a foregone conclusion, a way of life in business today. And they never seem to get any simpler, just more complicated!

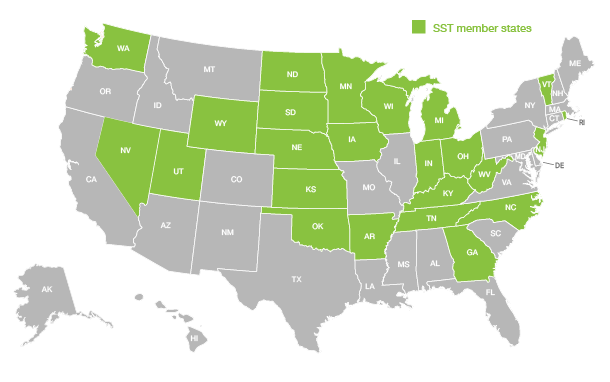

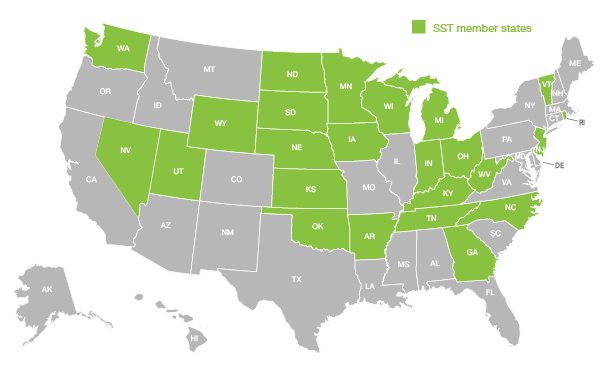

Twenty-four states are part of a state-subsidized program called Streamlined Sales Tax, or SST, to make sales tax compliance easier and more affordable for businesses. Due to two court rulings, National Bellas Hess v. Illinois in 1967 and Quill Corp. v. North Dakota in 1992, SST was created in 1999 to simplify the complex sales tax systems that led to these decisions. The Streamlined Sales and Use Tax Agreement (SSUTA) was created.

These are the current members of the SST:

Why does this matter? Previously, states were only able to tax sales by businesses if that business was physically present in their state. Now, however, due to the South Dakota v. Wayfair, Inc. decision in 2018, remote and online sellers are being taxed as well. It is economic activity, economic nexus in the state, that triggers the tax collection and liability, regardless of physical location. And the threshold of economic nexus is based on sales revenue, transaction volume, or a combination of both. With the increasing ecommerce market, the number of online sellers has grown dramatically, and out-of-state sellers are required to collect tax in more than 37 states, with more certain to be added to that number.

You can register your business with the SST to receive these standard benefits:

However, working with an SST Certified Service Provider (CSP) can help ease the burden and the cost of collecting and remitting multiple state taxes. The SST Governing Board defines a CSP in this way: “A CSP is an agent certified under the Streamlined Sales and Use Tax Agreement to perform all the seller's sales and use tax functions, other than the seller's obligation to remit tax on its own purchases. A CSP is designed to allow a business to outsource most of its sales tax administration responsibilities.” Sounds pretty good, doesn’t it! And, if your business qualities as a volunteer seller, you can avoid the standard fees in SST member states when you use a CSP like Avalara.

So how does a business qualify to be a volunteer reseller and reap these great benefits? The following criteria must be met during the 12-month period immediately preceding the date of registration with the member state:

It may sound like the volunteer sellers have the most to gain by using a CSP. Not true! There are benefits to working with a CSP for both non-volunteer and volunteer sellers. Avalara is one of the first CSPs certified by SST and has met rigorous standards for data processing and management of sales tax information. They are uniquely qualified to help your business with all aspects of sales tax compliance both in SST states and other states outside of SST.

Learn more about working with Avalara and your business will benefit!

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016