The current not-for-profit reporting model has been in place for more than 20 years. In an effort to simplify and improve financial reporting for not-for-profit organizations, the Financial Accounting Standards Board (FASB) announced in August of 2016 an update to the current standards. While the new standards do not take effect until December 15, 2017 (that is, fiscal years beginning after December 15, 2017), early application is allowed and encouraged.

The hope is that these changes will make ongoing non-profit financial statement preparation easier, but in the short term there will be some effort required to modify your nonprofit’s financial statement templates.

In Sage 300 (formerly known as Sage Accpac), financial statements are usually generated in one of two places; the Financial Reporter or the Sage Intelligence module.

If you use the Sage 300 Financial Reporter, you will need to use the Statement Designer to modify your statement templates. For example, if you are not already using the Direct Method for your Statement of Cash Flows, you will need to copy or modify you Indirect Statement of Cash Flows as a Statement of Cash Flows using the Direct Method is now required. (It is worth noting an Indirect Statement of Cash Flows is optional.)

If you use Sage Intelligence for your financial reporting needs, you will need to modify your statement templates in the Report Manager program. For example, if you need to update your Statement of Changes in Net Assets, you will need to run your existing statement, make your modifications, then right-click and “Save Excel Template” from the Report Manager.

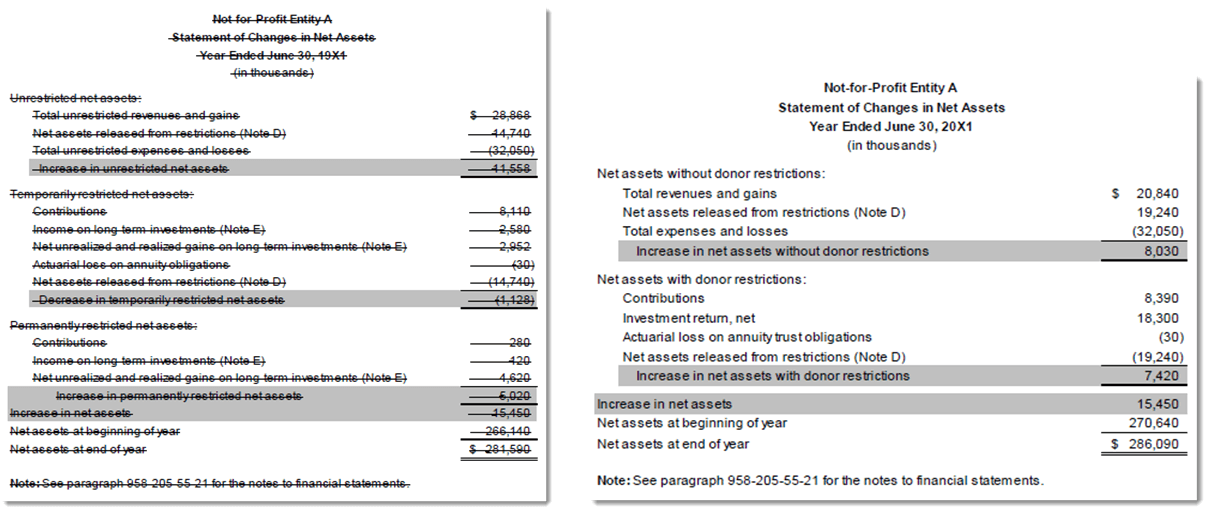

Example of new Statement of Changes in Net Assets format.

For both the Sage 300 Financial Reporter and Sage Intelligence it is a good idea to make backup copies of your existing financial statement templates before make any modifications.

The reporting requirements in the following areas are being revised:

For full details, read the announcement put out by FASB in August 2016.

Give us a call at (866) 436-3530 if you need assistance making these changes in Sage 300.

Or click the button below to watch a recorded web training session on Sage 300 Financial Reporter.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016