The IRS has introduced some changes to the 1099-MISC and the 1099-NEC filings for the 2021 reporting year. Sage has released a hotfix to accommodate all of these changes to the 1099-MISC and the 1099-NEC forms. This hotfix is only available for the supported versions of Sage, and these versions need to be updated to the latest product update.

For the 1099-MISC form, the most obvious difference is the title. Miscellaneous Income has been changed to Miscellaneous Information. Additionally, Box 11 now includes any reporting under section 6050R, regarding cash payments for the purchase of fish for resale purposes. This means that box 1 of the 1099-NEC form will no longer be used for reporting under section 6050R. Also, payers may use box 2 on the 1099-NEC or box 7 on the 1099-MISC forms to report any sales totaling $5,000 or more of consumer products for resale. But perhaps the biggest change of all is the resizing of the 1099-NEC form. The height of the form has been reduced in order to fit 3 (instead of 2) forms on an 8 ½ x 11 page.

If you have one of these Sage 300 versions, you can contact Equation Technologies to obtain the hotfix or you can download the hotfix for your specific version directly from Sage here.

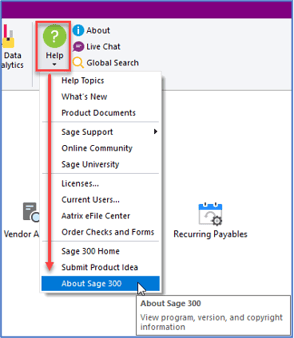

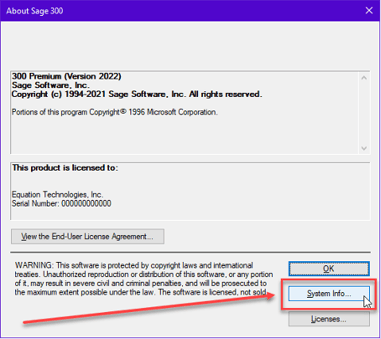

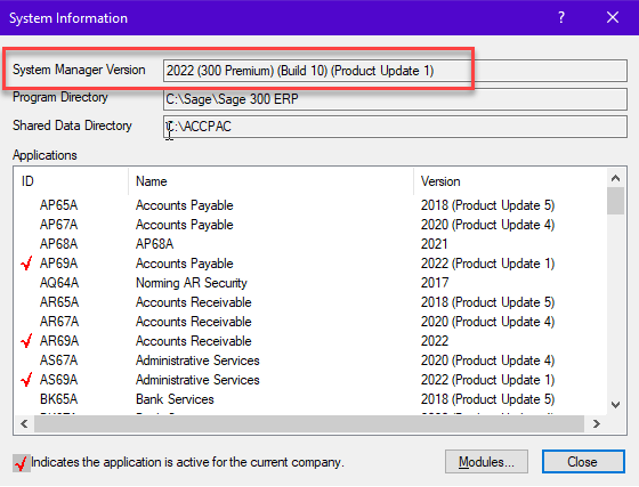

How to Check Your Sage 300 Version

Check your version by opening Sage and click on Help About Sage 300 System Information. Your version and product update number will be shown on this screen.

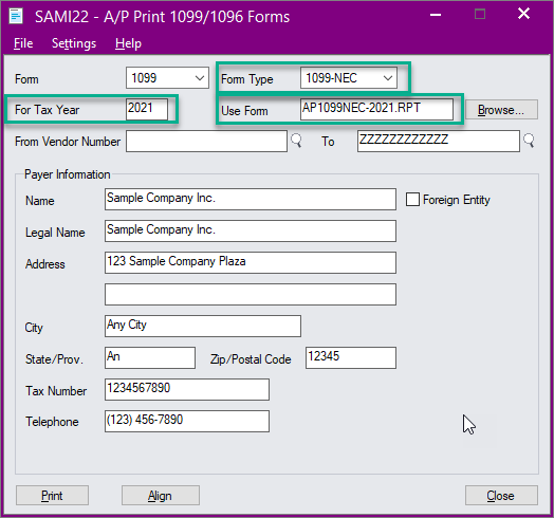

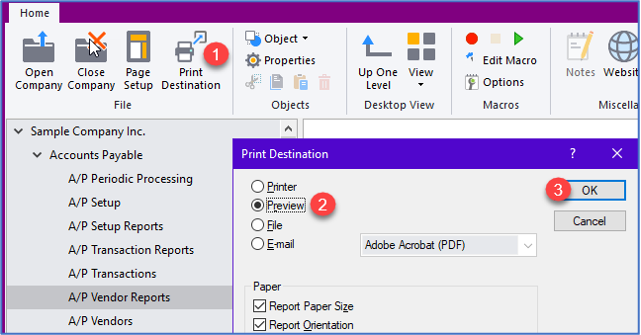

The hotfix consists of 5 program files, and 3 report files that need to be placed in the APxxA directory on each machine where Sage is installed. Once this is done, you are ready to print your 1099s.

The hotfix consists of 5 program files, and 3 report files that need to be placed in the APxxA directory on each machine where Sage is installed. Once this is done, you are ready to print your 1099s.

Unsupported Sage 300 Version?

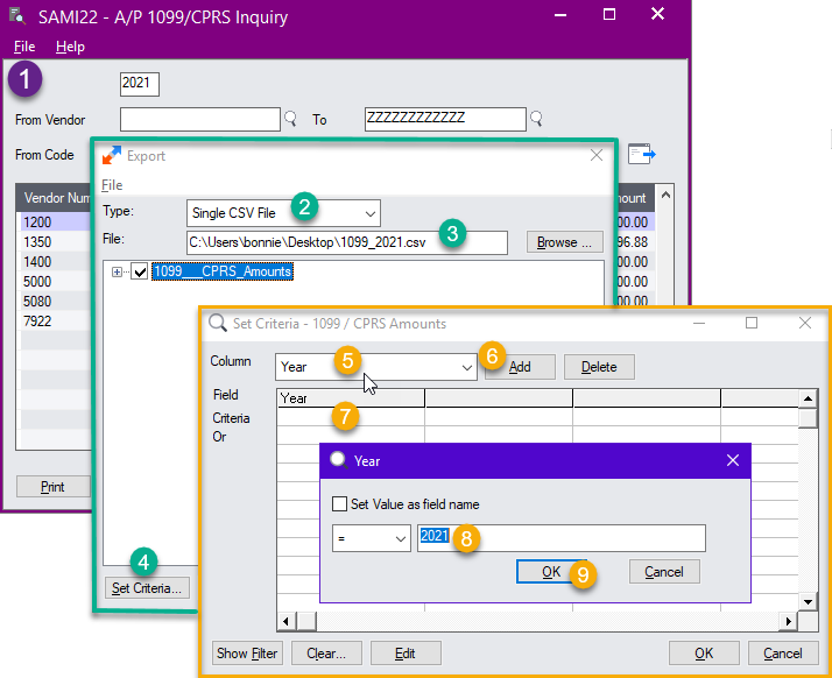

What happens if you are not on one of the supported versions of Sage 300 and your version is not eligible for the hotfix? You have the option to do your 1099 forms manually, however, this may be an enormous amount of work. The best option may be to export the 1099 information and use a third-party service for your filings.

When the export process is complete, locate your file and send it to your third-party service.

For any questions or assistance with any of the above steps, please contact Equation Technologies – we can help!

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016