The IRS has introduced the new Form 1099-NEC for reporting independent contractor income, non-employee compensation. The Form 1099-MISC is still in use, but only to report miscellaneous income and excluding non-employee compensation.

Sage has updated their programs to work with the new 1099-NEC forms. Here’s what you need to know:

1. Update your Sage 300 (Accpac) system to the latest product update.

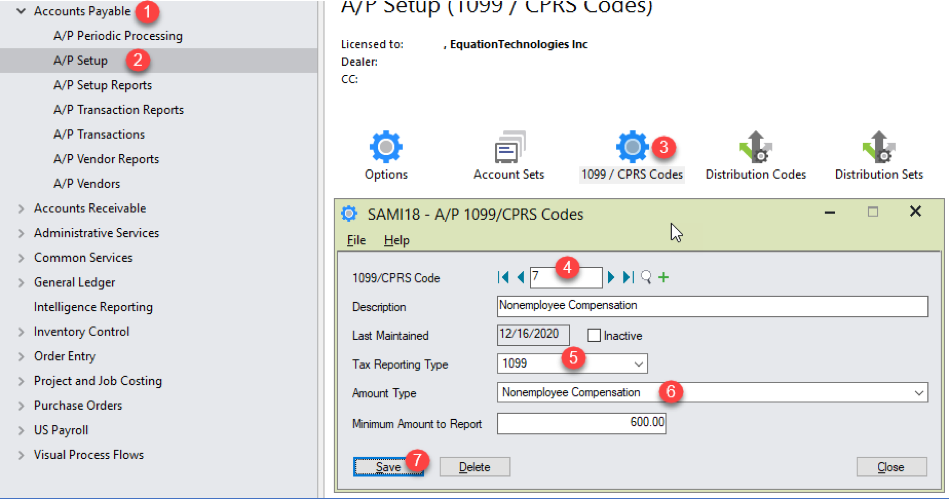

2. Once your product update has been installed, go to AP Setup, 1099 / CPRS Codes:

Enter your current 1099 code, and fill in the two new fields Tax Reporting Type and Amount Type. Make sure to do this step for all of your 1099 codes.

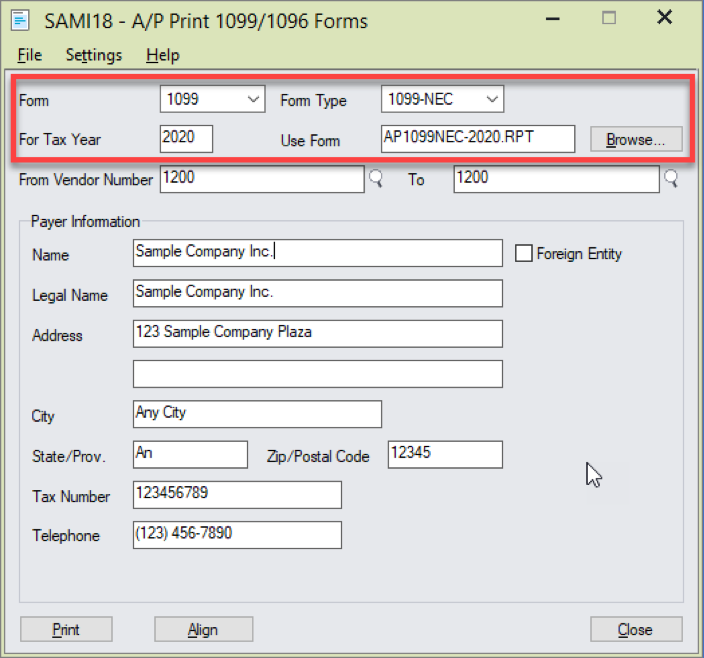

Select the Form 1099 and then enter the tax year 2020. When you enter the Form Type 1099-NEC, Sage automatically populates the Use Form field to be AP 1099NEC-2020.RPT. This is the new specification file that works with the new IRS forms. When you change the Form Type to 1099-MISC the Use Form field updates to the new AP 1099MISC-2020.RPT form.

Also note that the form types are sensitive to the tax year – if you enter 2019 for the tax year, you cannot select a Form Type 1099-NEC. When you try to print, Sage will pop up with an error that says “Form 1099-NEC is not valid for the year 2019.”

4. Sage has the ability to e-file 1099s. Go to AP Periodic Processing / 1099 Electronic Filing. Sage will create the file and then you can upload it to the IRS site with your FIRE account. Click here for information on FIRE accounts: https://www.irs.gov/e-file-providers/filing-information-returns-electronically-fire

At some point during year end processing, you may discover that the 1099 codes or amounts you’ve recorded for a vendor need to be edited or adjusted.

Contact us if you have questions or would like assistance with your year end processing.

Managing accounts receivables (AR) can feel like an endless game of cat and mouse. Small companies...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016