Bank reconciliations are one of the most tedious and time-consuming tasks that an accounting department must face. Once thought of as a monthly process, bank reconciliations are now done weekly, and even daily, in order to track cash balances and maximize cash potential. Using Bank Feeds in Sage Intacct makes sense in order to reduce the time spent on bank recs and help eliminate errors during the process.

Here are the steps needed to connect bank feeds to your Sage Intacct company:

Let’s take a look at those steps in more detail.

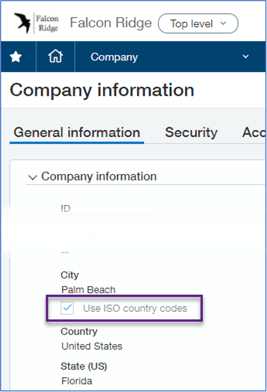

Ensure the option to Use ISO country codes is turned on in your Company Information

At the Top Level, go to Company, Setup, Company. On the General Information Screen, ensure that the option to Use ISO country codes is selected.

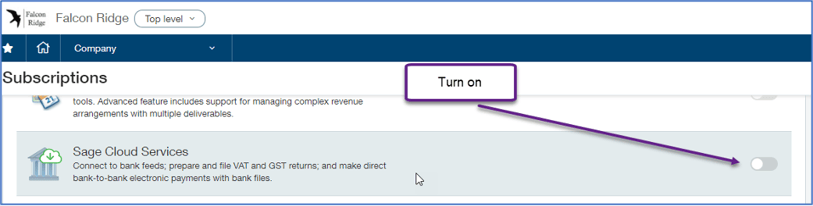

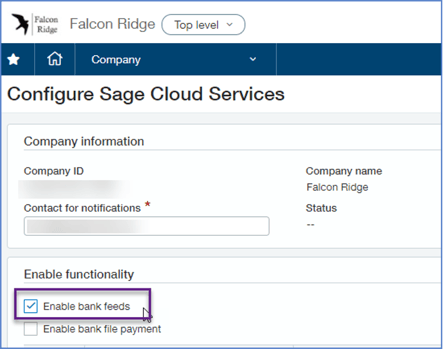

Subscribe to the Sage Cloud Services module and select the checkbox for Enable Bank Feeds

You will need to be using the new interface, the Active UI, in order to subscribe to and use bank feeds. Go to Company, Admin, Subscriptions. On the Applications tab, scroll down until you see Sage Cloud Services.

Turning the option on, will give you a warning that charges may be incurred. There is no cost to use bank feeds for up to 200 bank accounts per client. Charges will be incurred for more than 200 bank accounts. You will then be taken directly to the Configure Sage Cloud Services screen. Under the Enable Functionality section, select the option to Enable bank feeds. You can enable bank feeds at the Top Level to cover all the entities. If a new entity is added later, that entity will need to have Bank Feeds enabled at their level.

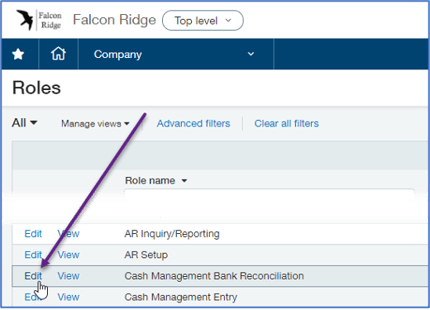

Update user or role permissions for Cash Management to include Bank Transactions

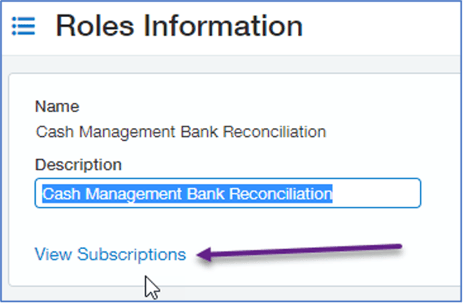

Go to Company, Admin, Roles. Click on Edit beside the role that needs to include Bank Transactions. Then click on View Subscriptions and click Permissions for the Cash Management Module.

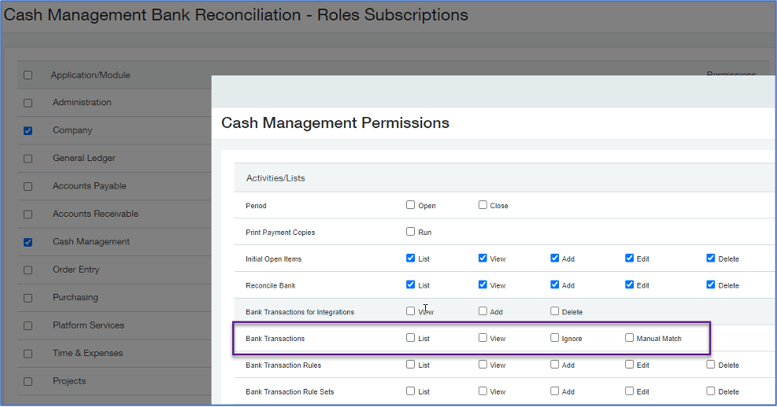

Turn on the necessary permissions for Bank Transactions.

These changes will affect all users who are assigned to that particular role. If you are using individual user permissions, you will need to go to Company, Admin, Users, and edit the rights for each user.

Connect your bank accounts to their bank feeds through Cash Management

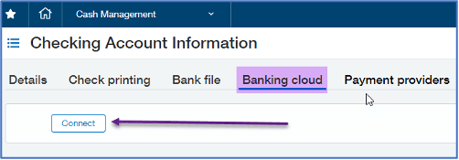

Go to Cash Management, setup. Click (Checking, Savings, or Credit Card) that you wish to connect to bank feeds. Select Edit next to the account that you want to connect with and go the Banking cloud tab. Click Connect.

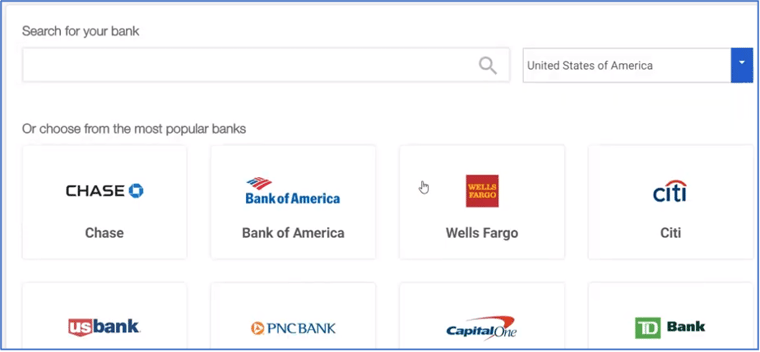

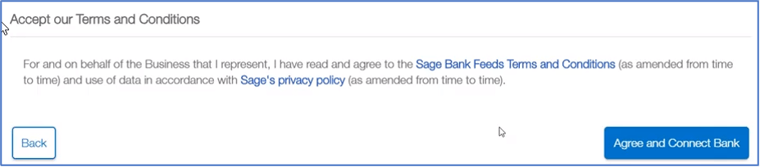

You will then be asked to pick your bank or search for it from the list. Once you have selected your bank, you will need to agree to the Terms and Conditions and click Connect.

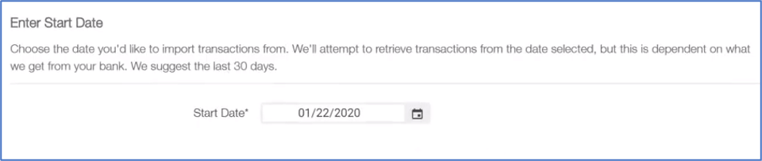

The next step will be to enter a start date for the transactions to be brought into Sage Intacct. It is recommended that the start date be no more than 30 days from the current date. If you select a date that Is farther back than 30 days back, you may not receive all of the transactions due to the bank’s limitation. They may not keep or send those.

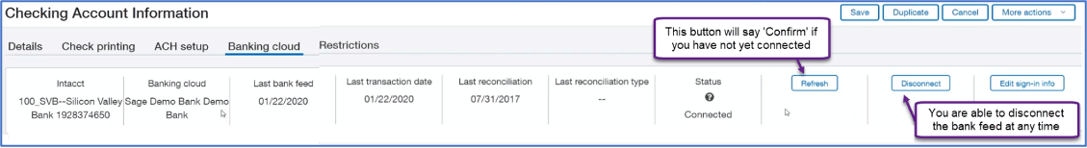

You will then see a box with all your banking info on the screen and you will need to click on the confirm button to complete the process. Then your transactions will be retrieved.

Now you are all setup to do your bank reconciliations and auto-matching of transactions. Or give us a call or email us anytime with your questions.

Most restaurant or franchise leaders feel the same way: Theyhave the data. They just never get it...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016