The thousands of financial services firms in the US each do something a little differently depending on where they are, who they serve, and what philosophy they follow. Despite the exciting variety in the industry, though, these firms tend to suffer from the same kinds of problems.

We will explore what those problems are and how to solve them in the next section. But let’s start with their origin. So many financial services firms have the same issues because they have the same accounting software. It’s adequate but under-powered, and in many cases it’s the same software the firm started with (QuickBooks is a likely culprit). Firms eventually outgrow their accounting software, but if they fail to upgrade, it creates a disparity between what they need and what they have. That disparity is common amongst firms of many different shapes and sizes, and all have these same three problems.

We will explore what those problems are and how to solve them in the next section. But let’s start with their origin. So many financial services firms have the same issues because they have the same accounting software. It’s adequate but under-powered, and in many cases it’s the same software the firm started with (QuickBooks is a likely culprit). Firms eventually outgrow their accounting software, but if they fail to upgrade, it creates a disparity between what they need and what they have. That disparity is common amongst firms of many different shapes and sizes, and all have these same three problems.

3 Problems that Plague Financial Services Firms

We help financial services firms optimize their accounting, which means we hear extensively about the accounting issues that firms struggle with. Here are the top three:

The bad news is that most firms suffer from all three of these problems at some point or to some degree. The good news is that they have a universal solution: Sage Intacct.

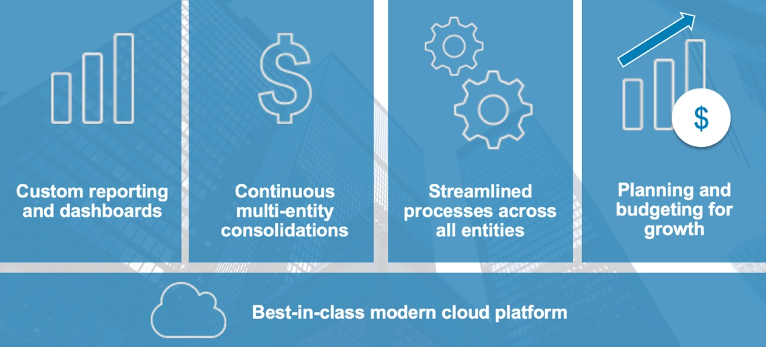

By implementing a robust, cloud-based financial management solution that handles all of the accounting along with the finer points of finance, firms gain a tool to fix all their problems. The close runs like clockwork, updated metrics arrive on demand, and reports burst with insights. And this is just the start. If you’re ready to see what your financial services firm is really capable of, unshackle yourself from the current accounting software and work with Sage Intacct instead. Equation Technologies would be happy to set up a demo. Contact us to find a time.

Most restaurant or franchise leaders feel the same way: Theyhave the data. They just never get it...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016