Are you ready for the Financial Accounting Standards Board (FASB) revenue recognition standards (ASU 2018-08 & ASC 606) for nonprofit organizations? Sage Intacct is way ahead of these standards and can help your organization comply. Sage Intacct’s Nonprofit Revenue Recognition tools will help you with the focus of the following standards.

These changes are being made to ensure greater standardization and make financial statements simple and consistent. The FASB has geared the changes to increase the understanding of nonprofit financial statements to their wide range of readers, from board members, directors, and members of the leadership team. ASU 2018-08 will help any and all readers of the financial statements, many of which do not have direct knowledge of finance and accounting, nor their governing rules, to be able to read and understand them.

Here are some questions to be considered:

Are the contributions received a donation or an exchange? Or is it partially both?

Does the donation come with or without donor restrictions?

Are there conditions applied to the contributions? Are these conditions time-sensitive, or milestone related?  The core product that Sage Intacct offers already contains many features to assist non-profit organizations. There are both Compliance and Disclosures Dashboards available that include updated financial statements formatted for the 958 requirements of ‘with’ or ‘without donor restrictions’ as well as disclosure reports. These reports can be used ‘as is’ or can be modified for your particular requirements.

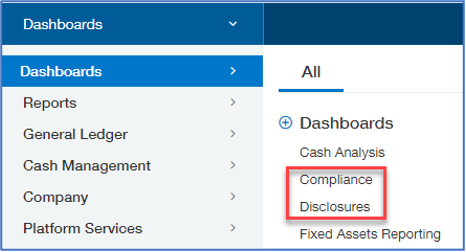

The core product that Sage Intacct offers already contains many features to assist non-profit organizations. There are both Compliance and Disclosures Dashboards available that include updated financial statements formatted for the 958 requirements of ‘with’ or ‘without donor restrictions’ as well as disclosure reports. These reports can be used ‘as is’ or can be modified for your particular requirements.

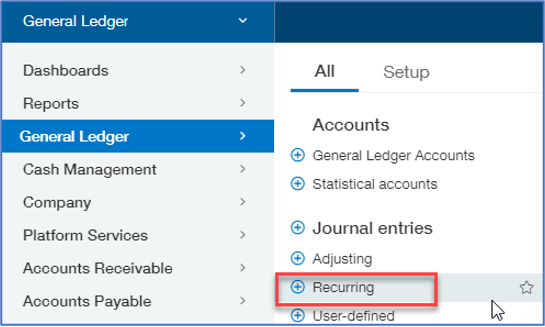

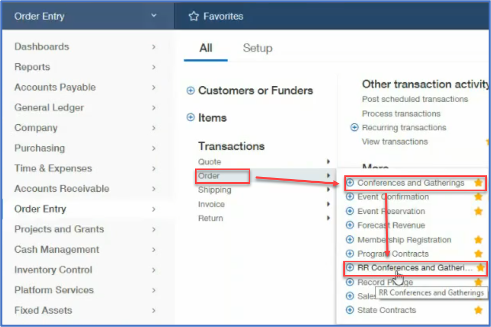

There is also the option to add a revenue recognition journal (under General Ledger / Journals) to use when recording year-end adjustments of deferred revenue, and those entries can be set to auto-reverse. There is also the ability to have recurring entries setup for your revenue recognition and have those entries set to be posted on a schedule. Additionally, Order Entry transaction definitions can be designed to create a workflow around your revenue recognition procedures.

These features are available ‘out of the box’ with the core Sage Intacct product. And they are very useful for low volume revenue recognition transactions, or if those transactions do not entail much complexity. However, if a more robust revenue recognition process is needed, then Sage Intacct’s Nonprofit Revenue Recognition toolset can be more helpful.

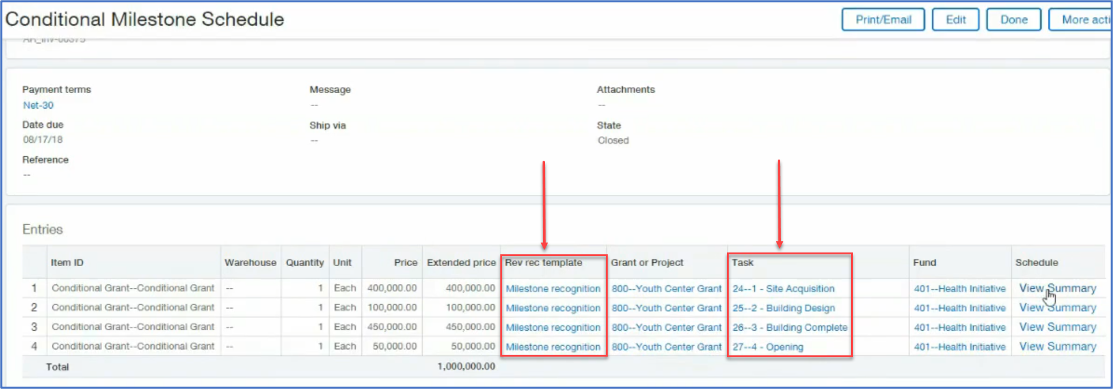

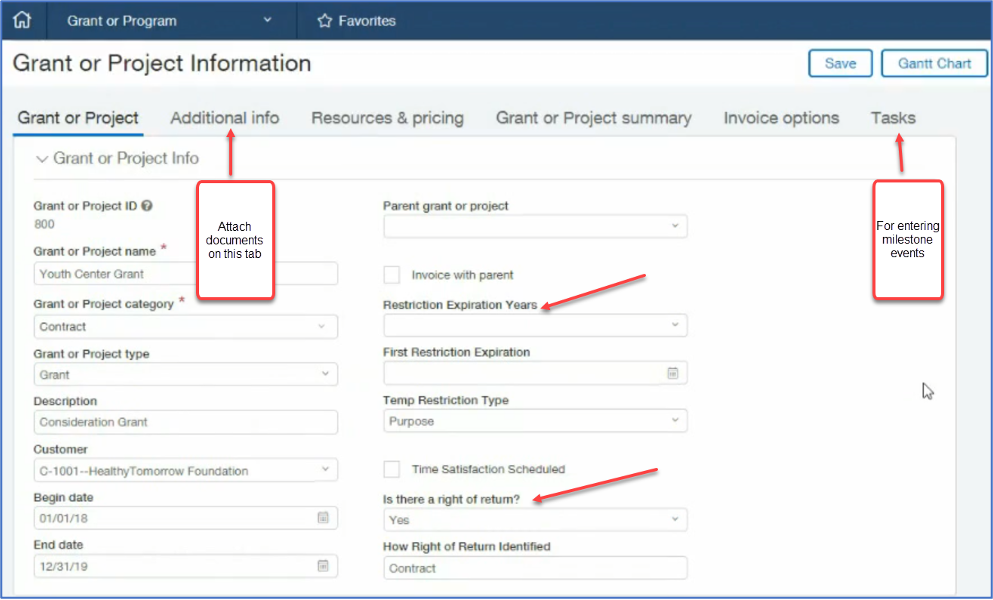

The Nonprofit Revenue Recognition toolset contains a Conditional Milestone Schedule that ties OE revenue recognition with the Project or Grants module and can record tasks (or different events) which are milestones for revenue recognition. These tasks will trigger revenue recognition which is completely separate from billing. The recording of the conditional grant will post to deferred revenue, and when the tasks are triggered, the revenue is recognized. The summary shows the amount of revenue that has already been recognized and what is left in deferred.

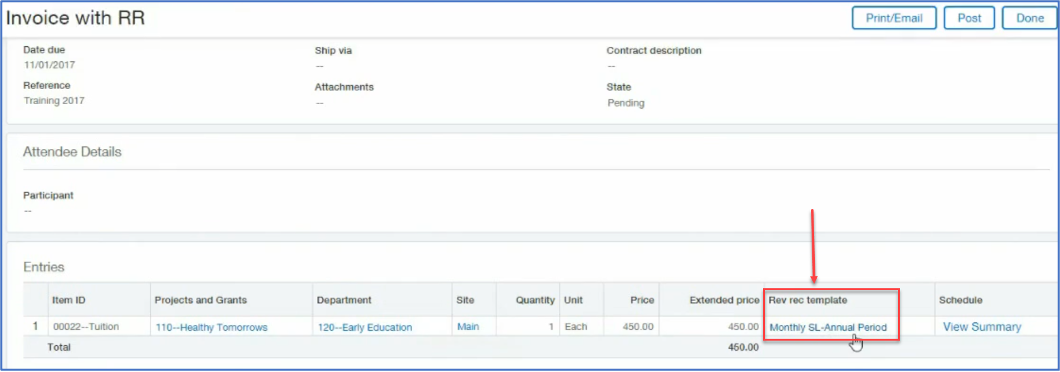

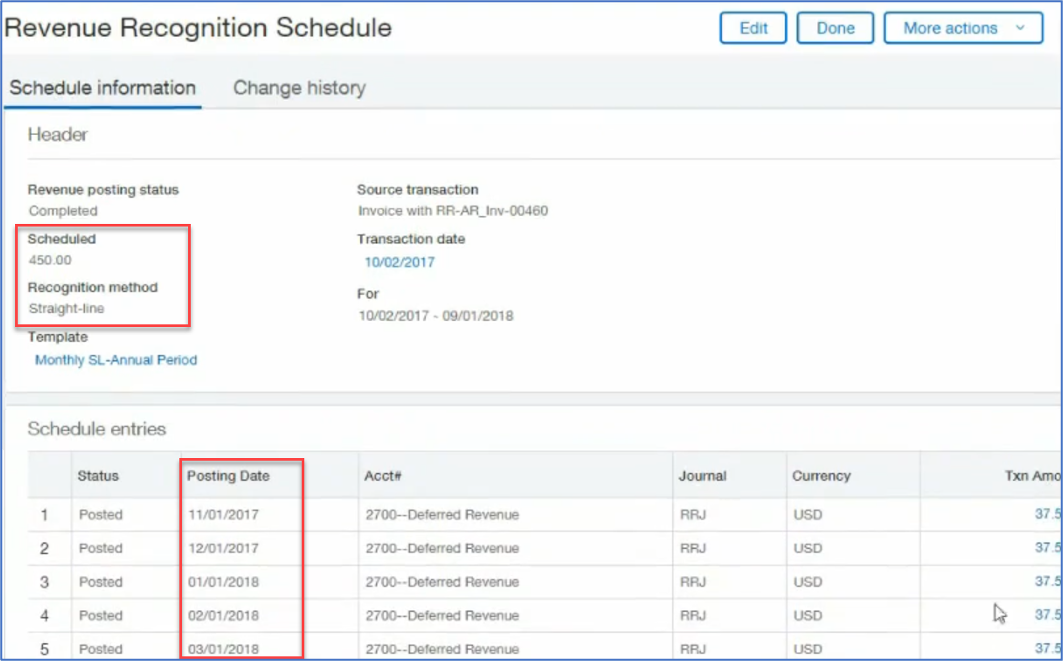

Time interval revenue recognition schedules can also be setup, again, completely separate from billing.

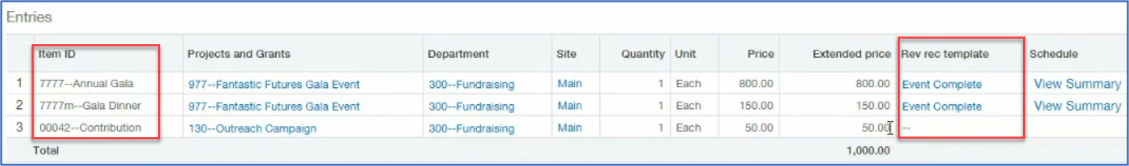

Bifurcation is also possible, to separate contributions from exchange in the same entry, by using different Item Id’s. You can even include line items that do not require revenue recognition in the same entry.

There is also an option in OE called Generate Invoices which allows you to recognize revenue based on expenditures from AP, Purchasing or Employee expenses.

To summarize, the Nonprofit Revenue Recognition toolset allows revenue to be recognized based on milestones, time intervals, or expenditures – or any combination of these.

Additionally, there is a place to centralize the Grant or Contribution information which also has the ability for document attachments and all the relevant information, such as restrictions or right of return, for that particular grant or contribution.

Listed above are only the highlights of Sage Intacct’s Nonprofit Revenue Recognition toolset. If you would like to take a deeper dive, give us a call or email us to schedule time with one of our knowledgeable consultants.

Most restaurant or franchise leaders feel the same way: Theyhave the data. They just never get it...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016