Sage Intacct 2020: Why Cash Management is Easier Than Ever

As part of the first release (R1) of Sage Intacct 2020, significant enhancements were applied to the Cash Management module and bank reconciliation process. Here’s a look at these updates, along with other improvements from recent prior releases, that are sure to make cash management easier than ever.

Electronic Bank Feeds

With Sage Intacct, gone are the days of file imports, manual reconciliations, and tedious adjustments and posting. With Bank Feeds, you can download your banking information directly to Intacct in the same way that many of us are accustomed to with personal finance applications like Quicken or QuickBooks.

With Sage Intacct Bank Feeds, you simply connect to your online bank account and download bank transactions directly into your company.

To enable bank feeds, go to Company > Admin > Subscriptions > Sage Cloud Services

Streamlined Bank Reconciliation

Each time you refresh a bank feed (see “Electronic Bank Feeds” above), your bank transactions are automatically matched to transactions already entered in Sage Intacct.

With companies processing thousands of transactions every month, the auto-matching process is a tremendous time-saver and will usually get you most of the way down the road toward bank reconciliation. However, if some items remain unmatched after the download and auto-reconciliation process, you can still manually match them or adjust any remaining transactions. What’s more, with improvements in Sage Intacct 2020 Release 1, the auto-match process now excludes any transactions you already manually unmatched.

Accounts Receivable employees can also view unmatched deposits on the Bank Transactions list page where they can receive customer payments. The deposit automatically matches to the received payment for reconciliation.

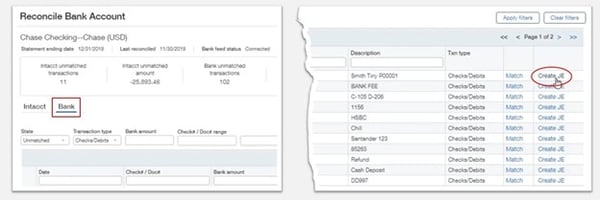

Simplified Journal Entry Creation

When adjustments are needed following a bank feed download and auto-reconciliation, new functionality in Sage Intacct 2020 R1 makes it easier than ever to initiate journal entry adjustments during the reconciliation process. With a single click on the new “Create JE” option, you can add the new transaction directly to the General Ledger from the ‘Reconcile Bank Account’ screen, as well as have the entry pre-populated with a “matched” status after creation.

Reopen a Reconciliation

Sage Intacct 2020 R1 now delivers the ability to reopen prior period bank reconciliations (a permissioned feature that must be enabled). With this functionality switched on, you can reopen reconciliation periods from the ‘Reconciliation Histories’ screen from an end period going forward. In other words, once a period is selected for reopening, all subsequent reconciled periods are automatically reopened as well.

Prior to Sage Intacct 2020 R1, opening a reconciliation that was several periods ago required you to reopen every single reconciliation until you worked your way back to the desired period requiring adjustment.

NOTE: With the release of Sage Intacct 2020 R1, Cash Management now defaults to the new Action UI for an enhanced user experience and interface.

Most restaurant or franchise leaders feel the same way: Theyhave the data. They just never get it...

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016