The Affordable Care Act (ACA) made life just a little more complicated for many of the HR and payroll departments we work with. Which of the new forms will you need to file? How many full-time employees do you really have? What are the fines for failing to provide affordable healthcare coverage? In this article, we'll show you how answering these (and other) questions and managing ACA reporting requirements is easier than you thought using Sage HRMS.

As a Sage customer, you have 2 great options that simplify the complexity of ACA compliance including:

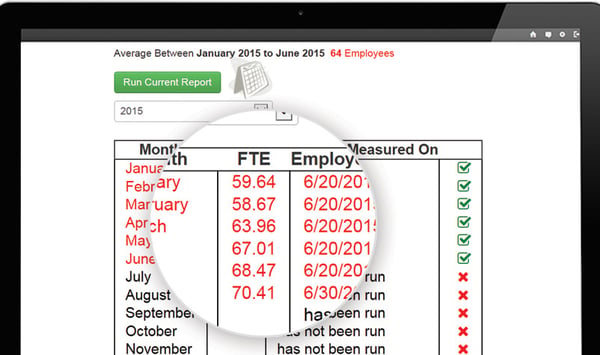

Flexible enough to meet the needs of a variety of employers, both ACA Comply and My Workforce Analyzer rely on integration with your existing Sage Payroll data (on-premises or hosted) to provide the tools, reports, and information you need to comply without entering data twice or managing two separate systems.

While both options may look slightly different from one another, they essentially offer the same set of features designed to minimize tax liability, avoid potential penalties, and simplify ACA compliance reporting.

Here’s a look at the features and benefits included in ACA Comply and My Workforce Analyzer:

With the new consent tracking capability, you can store the expressed agreement to receive marketing via email, text, or calls on the Consent Tab in contact records. Requests for consent can be sent directly from Sage CRM using preconfigured email templates.

If ACA compliance requirements have made your life a little more challenging, it may be time to consider a new approach using ACA Comply or My Workforce Analyzer.

Equation Technologies

United States: 533 2nd Street Encinitas, CA 92024

Canada: #301 - 220 Brew Street Port Moody, BC V3H 0H6

Phone: 866.436.3530 • E-mail: info@equationtech.us

Equation Technologies ©2016